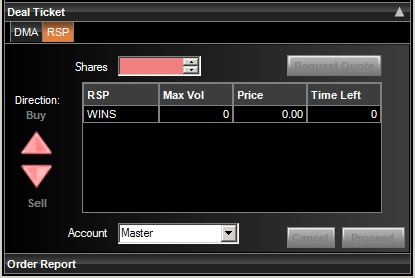

Deal RSPRSP stands for Retail Service Provider. RSPs are market makers who will offer a price in a fixed size. This price may often represent an improvement on the SETS bid or offer (in size or price) or may enable you to trade quote driven stocks online.  Obtaining a QuoteTo obtain a quote from an RSP, select Buy or Sell, enter the size you need and press the ‘Request Quote’ button. You cannot get a two-way price. Any RSPs who have an interest will respond with a price that will remain firm for up to 15 seconds. Select the quote that you would like to accept and press Proceed to place the trade, or Cancel if you don’t want to deal. Dealing EtiquetteTrading directly with a market maker over an RSP is not normally available to non-members of the LSE. As the provider of L2 and as a member of LSE, the order is being placed in our name. It is important, therefore, to observe the correct etiquette of dealing over this system. We, as the provider of L2, have to consider the needs of all our clients dealing with an RSP, and so will be forced to quickly remove any single client's access to the RSP if any market maker complains. Market etiquette is broadly common sense, however, so this should not discourage a trader from using the RSPs. Some of the actions which may breach accepted etiquette include: Asking for multiple quotes without dealing Dealing on Moving StocksParticularly in the case of SEAQ stocks, the RSPs are concerned about being 'picked off' if they have not managed to move their price on a momentum driven stock. With fast-moving SEAQ stocks, it is better to phone an order through. While the definition of a moving stock may be subjective, the RSP will exercise his right as to who he deals with. Momentum-driven traders will not be entertained. Dealing with an RSP and the Order BookIf you have an order for 20,000 shares and the RSPs are making prices in 10,000, you cannot buy 10,000 then immediately buy another 10,000. Similarly, you should not buy 10,000 through the RSP and then buy another 10,000 on SETS. Naturally enough, the RSP needs to be given a chance to unwind a part of the position he has taken on if need be. If you need to buy 20,000 you can either leave this as a Limit Order, or phone the order through to the dealing desk. |